Crisis Note 2008-1: The Future is Here

04/04/2008

and there is no way to avoid it. Martin Wolf says it better than I can.

http://www.ft.com/cms/s/0/d3321cc4-ffef-11dc-825a-000077b07658.html

I've been asked by many as to when my next Crisis Note was coming out. I've started numerous ones, but given up on each one. All the stuff the Fed has done this year has not really been worth commenting on: it's been like using a very large BB gun to shoot at a charging rhino! It may look like you're doing something, but you're better off praying or running. This is a large part of the reason I've not yet put out a Crisis Note this year - all I'd have said every time the Fed did something is that it will not work – it has all just been a massive waste of taxpayer money. The one thing they have accomplished is to stabilize a broker-dealer community that was terminally ill - now they are in a coma.

I'm getting arguments that the world is better for the Fed's and Congress's actions - investment banks are more solvent with the Fed backstop, the stock market is up, etc.

Here are my questions:

* Has commercial lending gone up?

* Do the Banks really have any spare capital to lend out?

* Are levered loans clearing?

* Are FNMA / FRE insuring more MBS?

* Have we found 5 million more **qualified** homeowners to take over the foreclosures, current and projected?

I think perception is trumping reality for now, but I believe it to be short-lived.

About all we can say is that we now know that the Fed cares.

I'll repeat what I said in 07's Crisis Notes: the fundamental problem is that we have created way too many assets (globally).

I'll repeat what I said in 07's Crisis Notes: the fundamental problem is that we have created way too many assets (globally).

Without leverage, there is not enough equity to own these assets. The Fed has $1 trillion (just under). The SWFs (sovereign wealth funds) have approximately 2,2T. Plus whatever the hedge funds have. 4 Trillian dollars will not be enough worldwide. Assets prices, as a whole, will continue to decline, and capital markets will not be orderly.

If anything, the Fed has made things worse for the economy by creating a place for the investment banks to hide assets and thus not recognize market prices (which do discount the future) for their assets (like Japan did). One has to only look at the growth in homes-for-sale inventories, or foreclosures, to recognize this is only just starting.

For some reality, see these Bloomberg links:

For some reality, see these Bloomberg links:

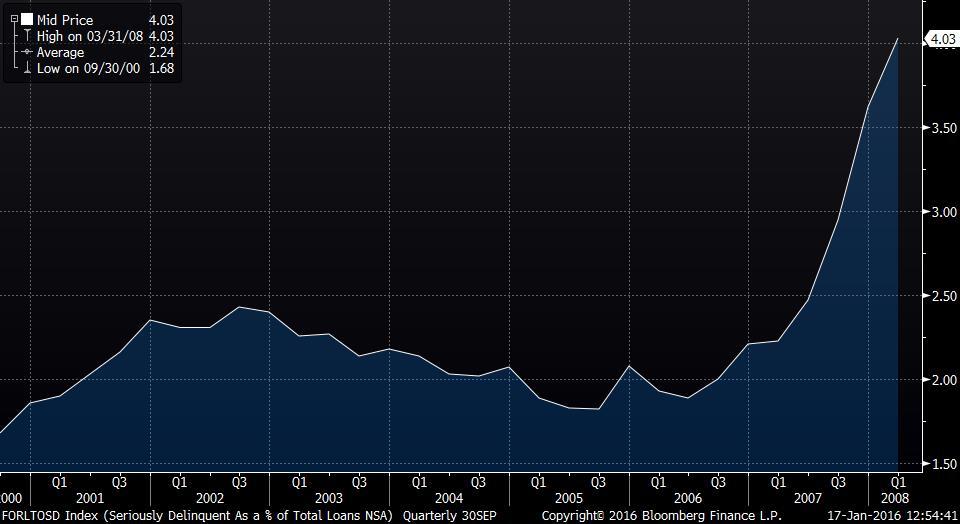

{DLQTFORE Index GP }. Yes, Foreclosure % of total resi loans outstanding = 2.04% as of 12/2007, and rising)

{FORLTOSD Index GP } Seriously DQ loans 3.62%

Don’t forget the loss in local tax revenue all this is going to cause as well. This will lead municipalities to raise property taxes on the remaining homes. Guess what that'll do to house prices.

Sorry.

Sorry.

Samir Shah, 04/04/2008